Emini Futures Trading / Zone To Zone

April 11, 2011 at 5:32 PM

April 11, 2011 at 5:32 PM Day Trading Strategy101. The 1st hour of trading will tell you a lot!!

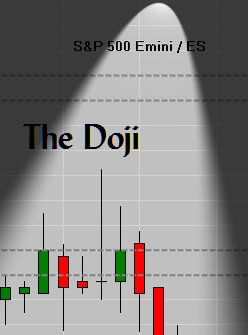

In the “training room” this morning our CFRN members were on HIGH ALERT. The 1st hour of trading(0830-0930) was the qualifier. Depicted in the chart, a nice “doji” set up gave us a SELL SIGNAL to act on.

By the way if you don’t know what a “doji” is or if you're not up to speed on your candlestick formations, the DTPro platform will color code them for you. How easy is that?

Now the question was where to get in, were do we put the stop and what's our target?

Members were notified to look at the Weekly Trading Zone(WTZ) or the 1326/1327 (ESM11) levels. Depending on your risk tolerance the entry was clearly defined. The risk or the stop loss was the easy part, the top of the “doji” or 1330.25 (ESM11) was the defined risk level. The target was another easy part of the equation; since our members get their WTZ levels every Sunday night a test of the 1317/1316 area would be targeted for a set up like this. Some traders may have elected to exit part of their position as we approached Dynamic Support (the green dots) @ 1320.75.

This Dynamic Support originally printed on the open Sunday evening and stood the test of falling prices for 2/12 hours before the final target at 1317 was reached. Often establishing a target 1 or 2 ticks below or above the WTZ is a prudent move. Here's a shot of the entire session which highlights not only the Doji Sell Signal but also the power of the WTZ.

BETWEEN the LINES

Those who follow our tweets already know this... but for the rest of you -

Lock in profits on YM Trade / market currently trading 12382http://cfrn.net/apply to learn how to make these trades!#emini #futures

The YM Trade tweeted last night was triggered and is still in play.http://twitpic.com/4jmp7c

STAY ALERT STAY ALIVE

Burton Schlichter

If you're spinning your wheels daytrading the S&P Eminis and other markets join us for a week . Watch and listen as we call out trades and setups in a LIVE real-time environment.

learn to trade eminis,

learn to trade eminis,  sp emini

sp emini

Reader Comments